HyperBridge – Unified Lending Operations Hub

HyperBridge – Unified Lending Operations Hub

HyperBridge Unified Lending Operations Hub

Streamline lending operations, capture quality leads, and connect with the right lenders all from one intelligent platform

Streamline lending operations, capture quality leads, and connect with the right lenders all from one intelligent platform

Built for Lenders of all sizes- Small NBFCs, Coop-Banks, Credit Socities, DSAs, LSPs, Digital Lending Aggregators, and Fintechs who want to simplify workflows, scale faster, and unlock new growth opportunities.

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Built for Lenders, DSAs, LSPs, Digital Lending Aggregators, and Fintechs who want to simplify workflows, scale faster, and unlock new growth opportunities.

Built for Lenders, DSAs, LSPs, Digital Lending Aggregators, and Fintechs who want to simplify workflows, scale faster, and unlock new growth opportunities.

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Explore Features

Request Demo

Request Demo

Request Demo

Request Demo

Request Demo

Request Demo

Request Demo

Request Demo

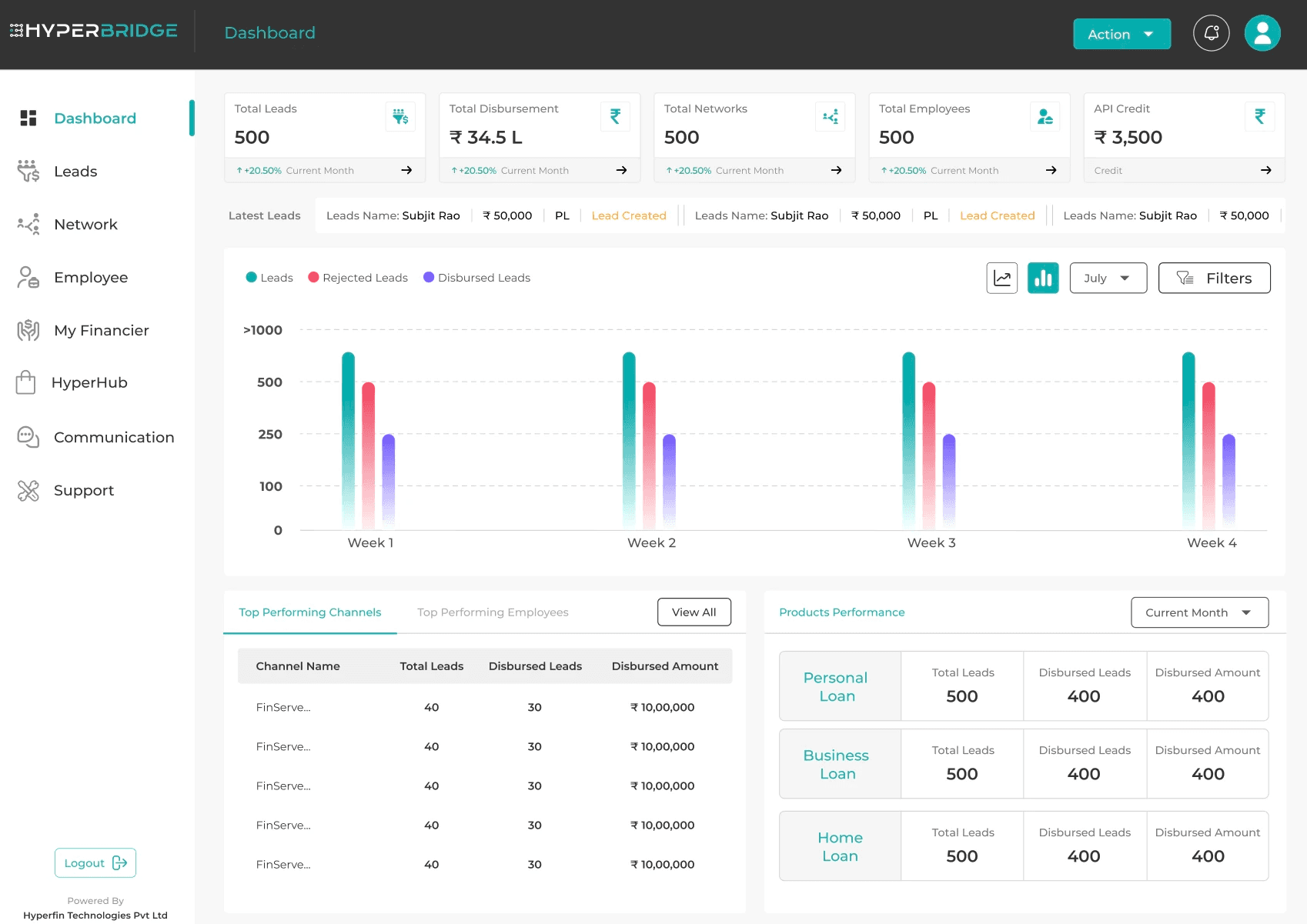

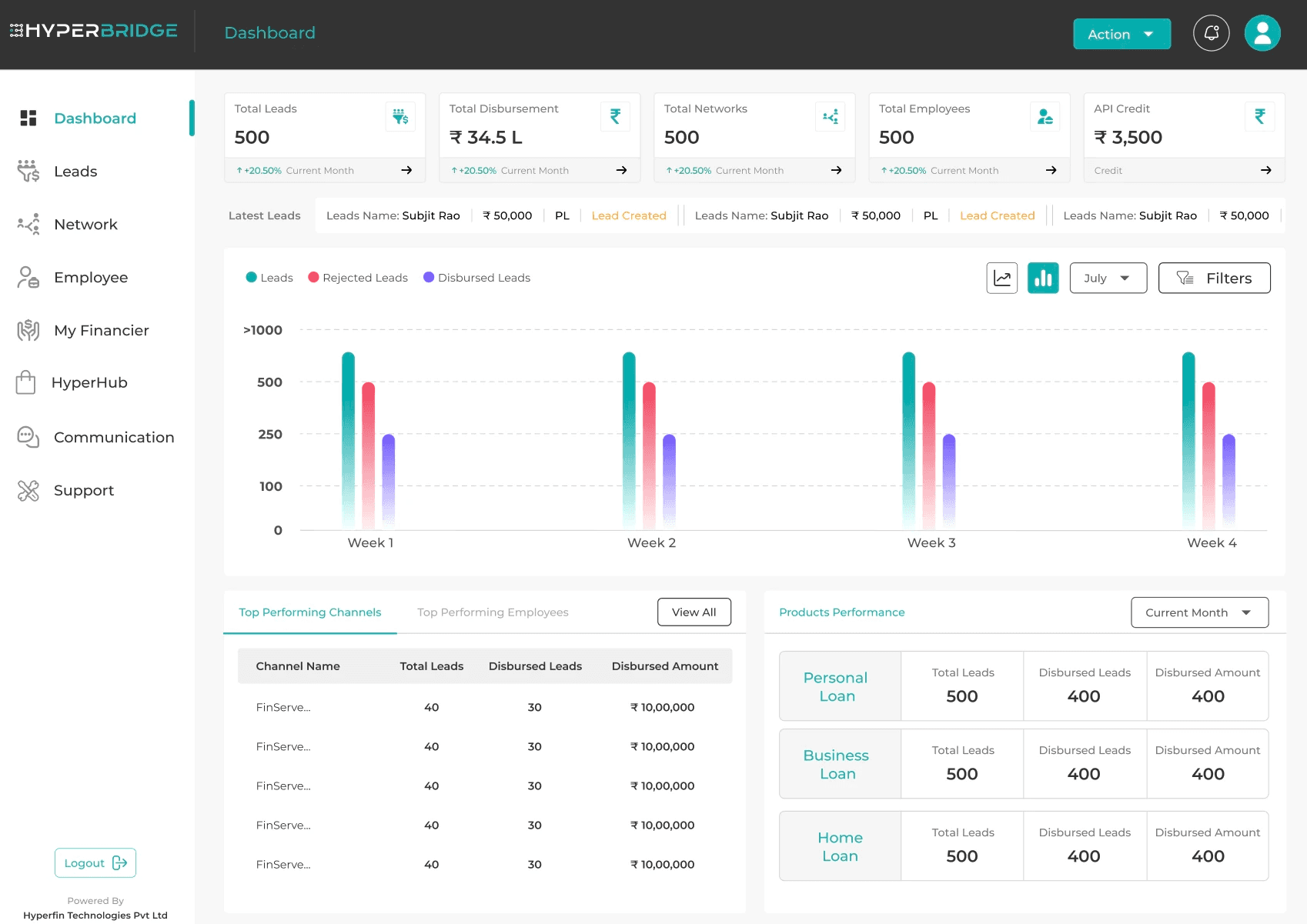

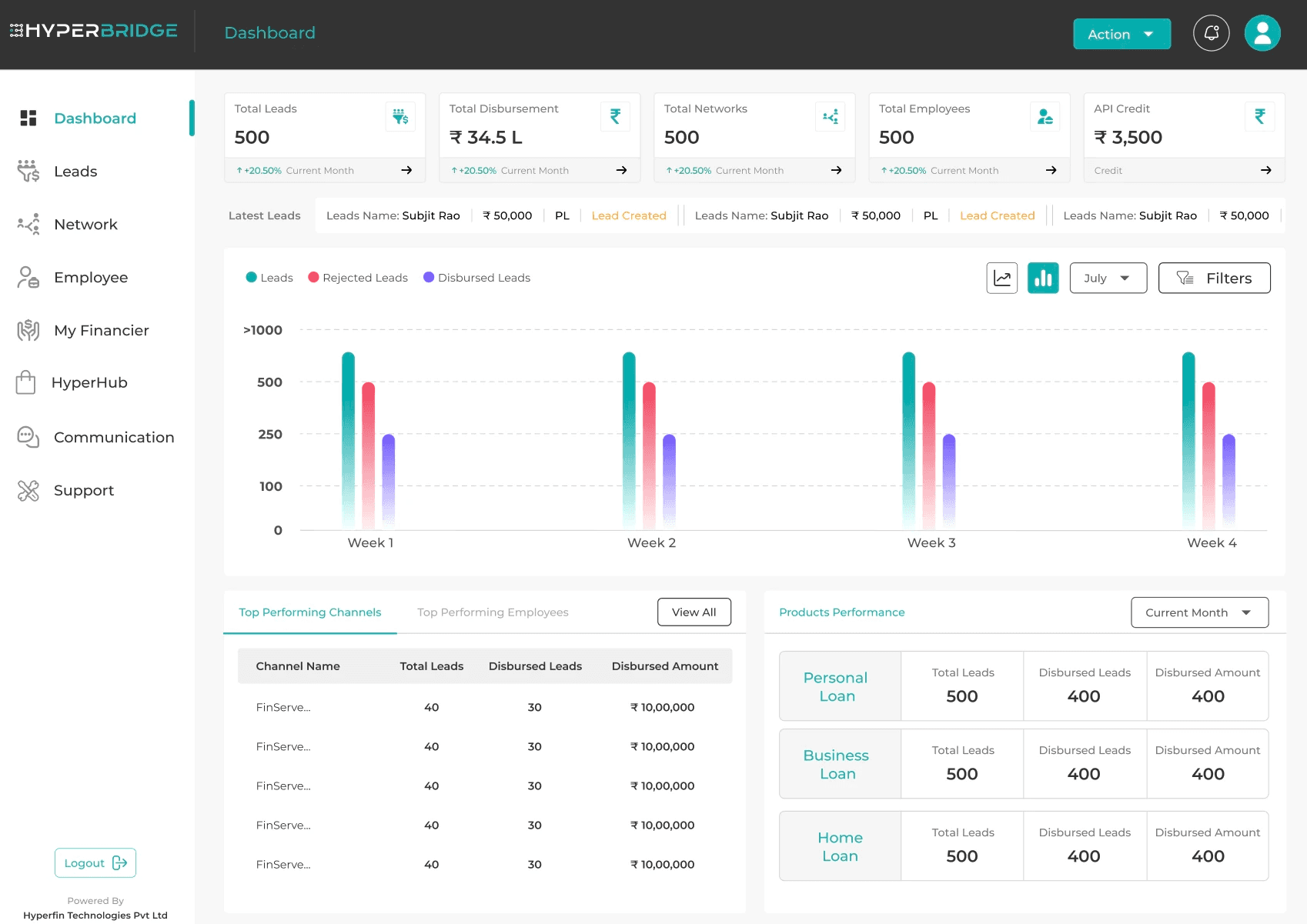

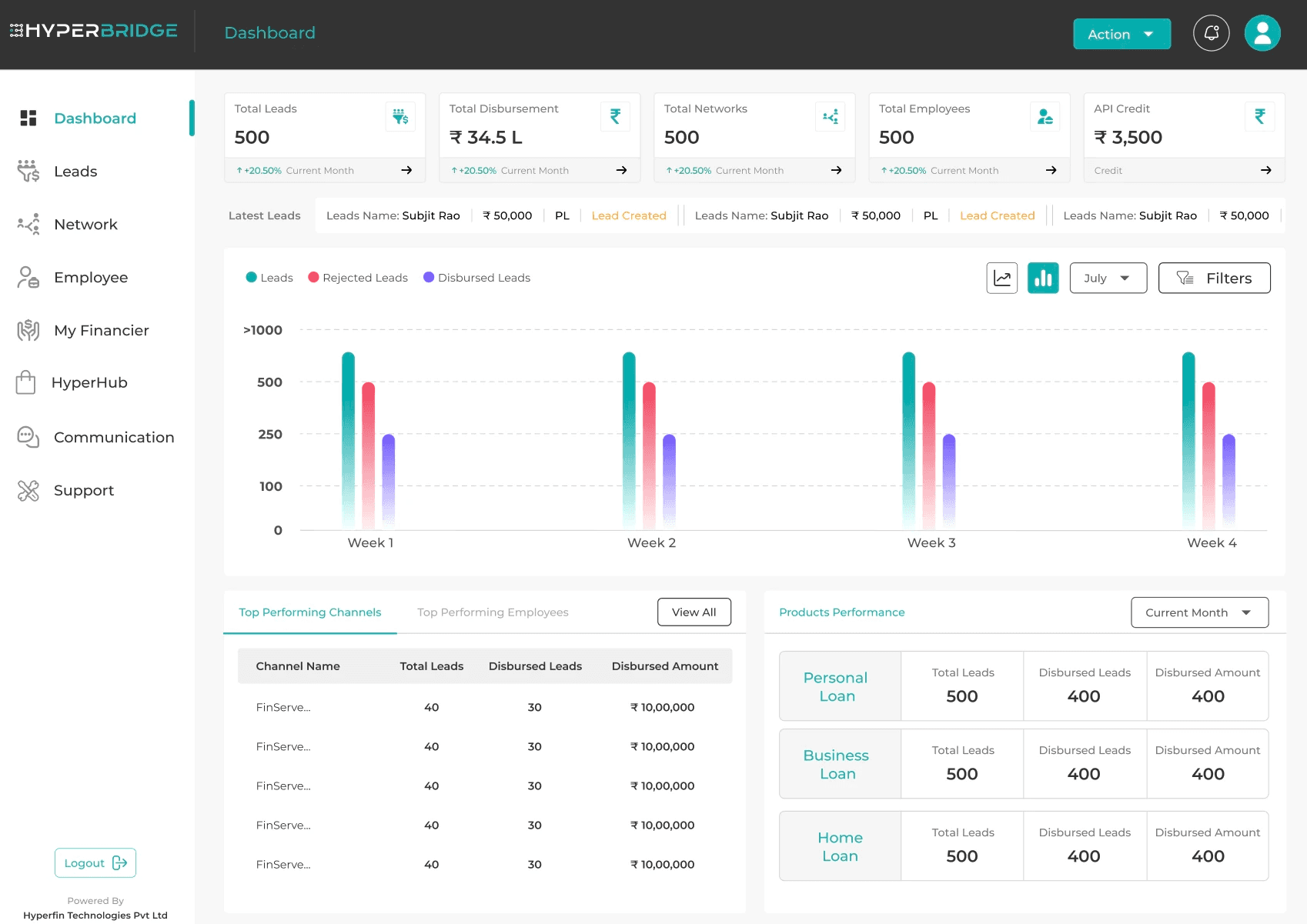

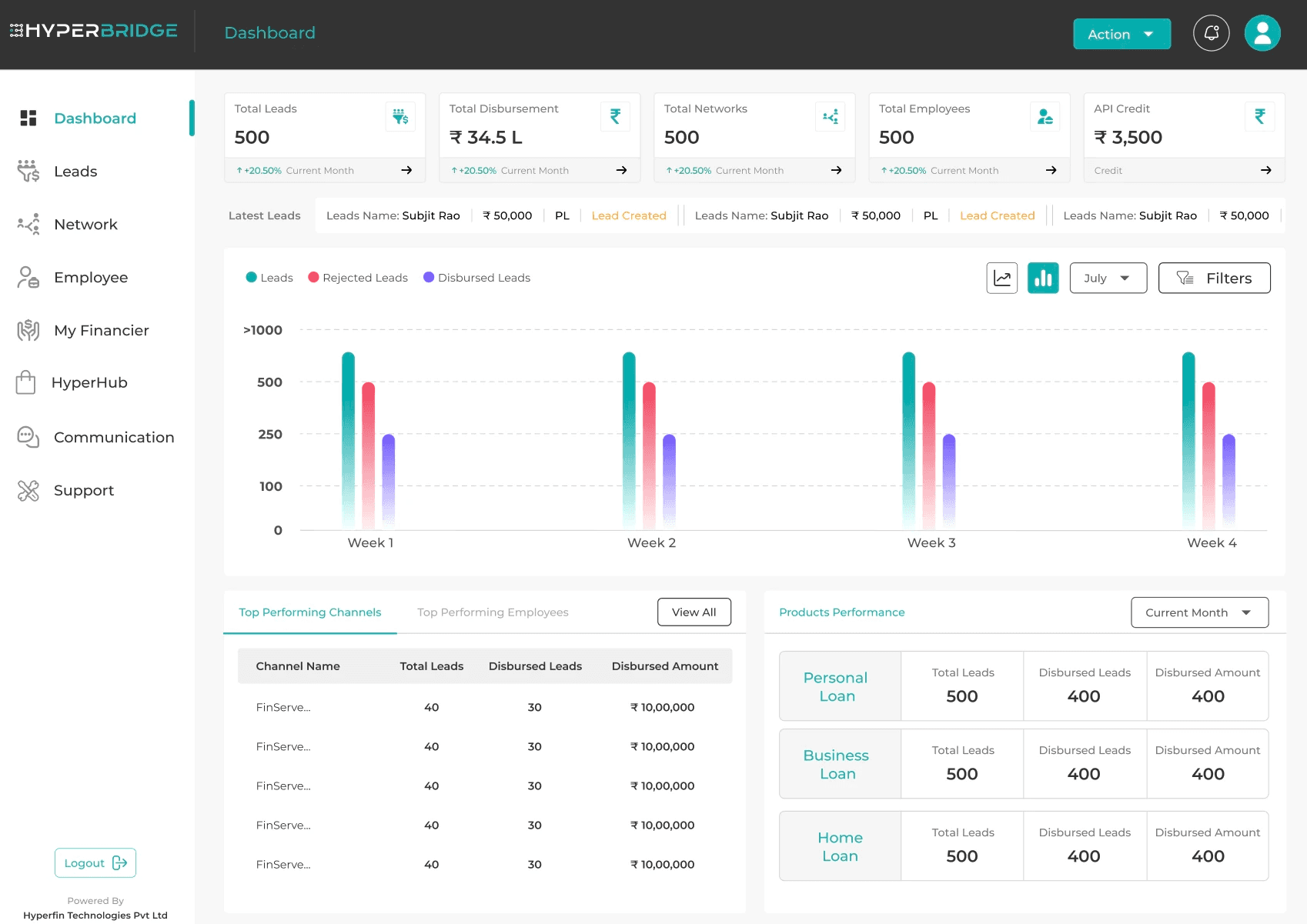

Comprehensive Dashboard

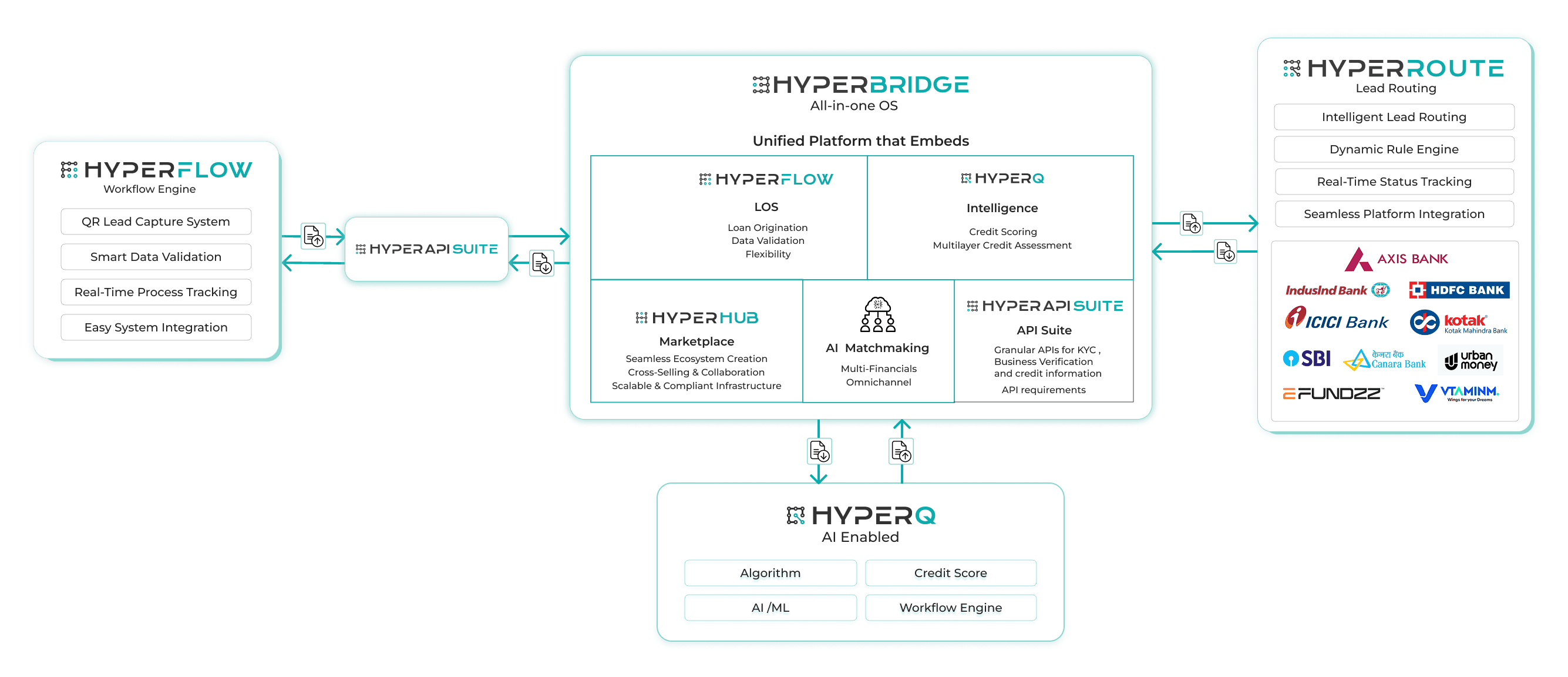

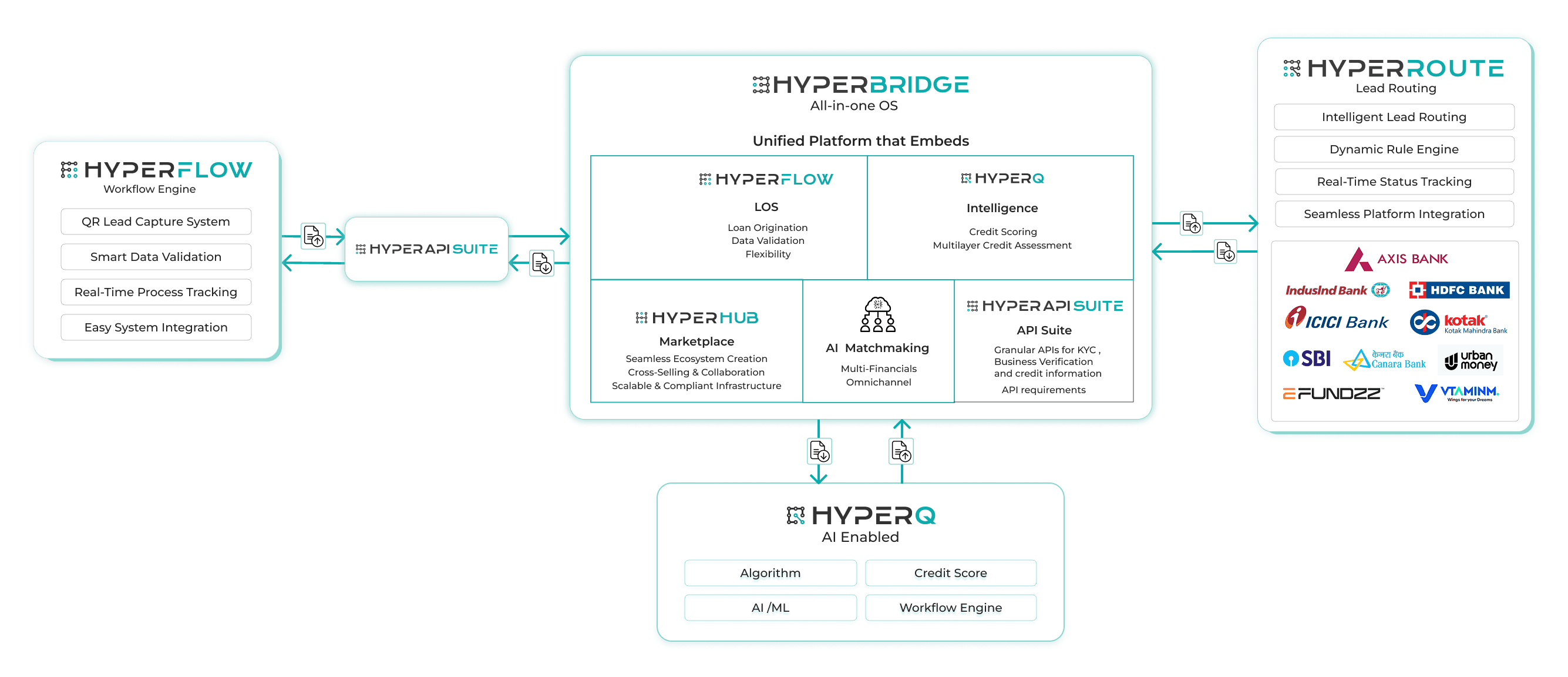

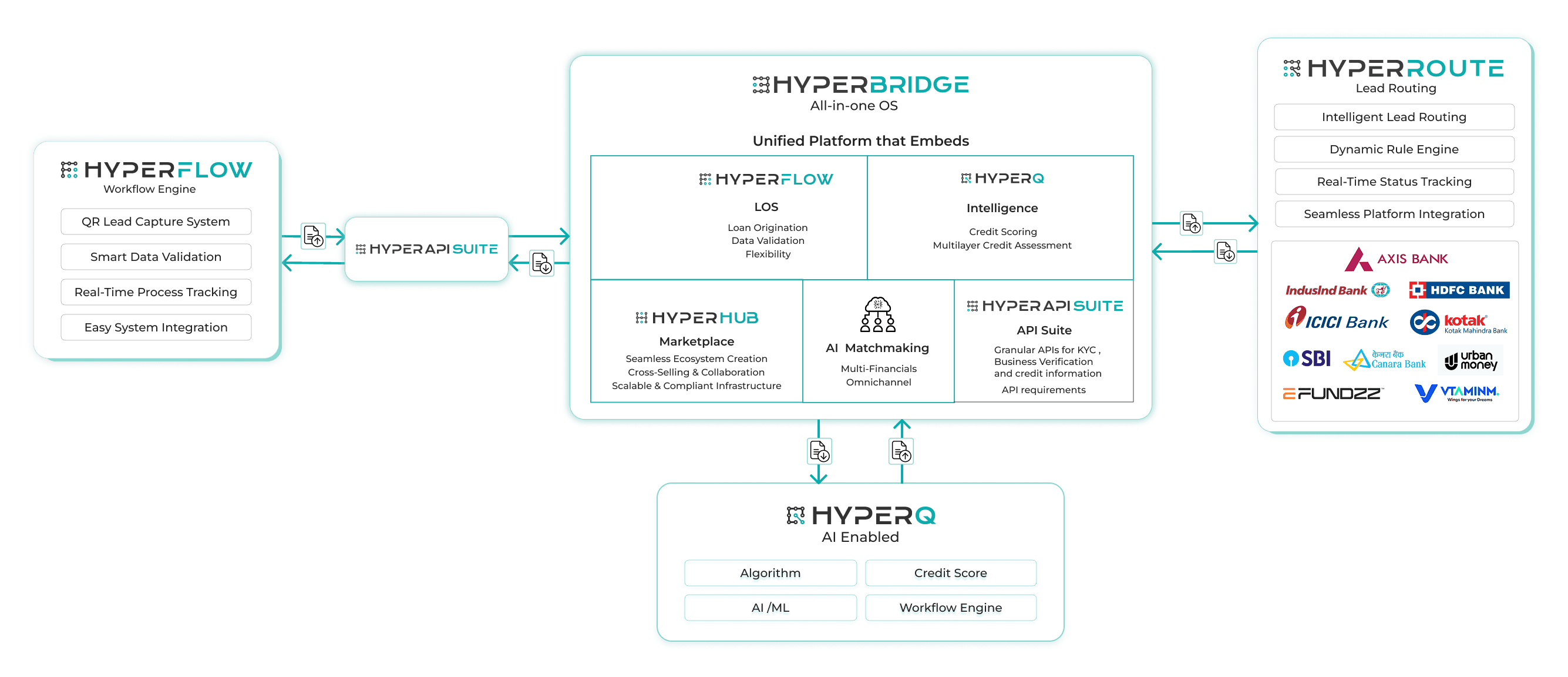

HyperBridge unifies every component of modern lending into one intelligent platform. Our ecosystem seamlessly integrates workflow automation, AI decisioning, and multi-lender routing while maintaining real-time tracking across 15+ major financial institutions.

HyperBridge unifies every component of modern lending into one intelligent platform. Our ecosystem seamlessly integrates workflow automation, AI decisioning, and multi-lender routing while maintaining real-time tracking across 15+ major financial institutions.

HyperBridge: Your All-in-One Lending Operating System

HyperBridge unifies every component of modern lending into one intelligent platform. Our ecosystem seamlessly integrates workflow automation, AI decisioning, and multi-lender routing while maintaining real-time tracking across 15+ major financial institutions.

HyperBridge unifies every component of modern lending into one intelligent platform. Our ecosystem seamlessly integrates workflow automation, AI decisioning, and multi-lender routing while maintaining real-time tracking across 15+ major financial institutions.

Comprehensive Dashboard

Your plug and play Intelligent Lending Platform

What is HyperBridge?

HyperBridge is a next-generation automation platform designed to unify lending operations across channels. With embedded AI powered by HyperQ, real-time dashboards, and secure API integrations, it empowering loan intermediaries to build scalable operations.

Qualify leads from both physical and digital channels

Connect with multiple lenders through one hub

Manage networks, partners, and employees with complete transparency

Unlock faster conversions with AI-driven borrower—lender matchmaking

Unlock faster conversions with AI-driven borrower—lender matchmaking

Seamlessly Connect

Unified API Gateway

Network Management

AI Matchmaking

AI Matchmaking

Lead Qualification

Risk Assesment

Lender Matching

HyperQ AI Engine

Intelligent automation at the core

Comprehensive Dashboard

Your plug and play Intelligent Lending Platform

What is HyperBridge?

Lead Qualification

Risk Assesment

Lender Matching

HyperQ AI Engine

Intelligent automation at the core

HyperBridge is a next-generation automation platform designed to unify lending operations across channels. With embedded AI, powered by HyperQ, real-time dashboards, and secure API integrations, it empowering loan intermediaries to build scalable operations.

Unified API Gateway

Connect with multiple lenders through one hub

Seamlessly Connect

Qualify leads from both physical and digital channels

AI Matchmaking

Unlock faster conversions with AI-driven borrower—lender matchmaking

Network Management

Manage networks, partners, and employees with complete transparency

Core Features

Capture leads, manage networks, and scale lending with automation, intelligence, and compliance—so you can grow faster and work smarter.

Real-time Dashboards

Monitor leads, approvals, and disbursals instantly. Get a 360° view of your lending ecosystem at your fingertips.

Real-time Dashboards

Monitor leads, approvals, and disbursals instantly. Get a 360° view of your lending ecosystem at your fingertips.

AI-powered Credit Matchmaking

Powered by HyperQ, HyperBridge intelligently connects borrowers with the right lender, boosting conversion rates.

AI-powered Credit Matchmaking

Powered by HyperQ, HyperBridge intelligently connects borrowers with the right lender, boosting conversion rates.

Smart Lead Capture & Validation

Collect, validate, and route leads instantly for higher accuracy and faster processing.

Smart Lead Capture & Validation

Collect, validate, and route leads instantly for higher accuracy and faster processing.

Network & Partner Management

Onboard partners, track agents, and optimize team performance seamlessly across all your channels.

Network & Partner Management

Onboard partners, track agents, and optimize team performance seamlessly across all your channels.

Employee Management

Streamline workforce operations with intuitive dashboards, automated workflows, and performance tracking.

Employee Management

Streamline workforce operations with intuitive dashboards, automated workflows, and performance tracking.

Data-Driven Insights

Access real-time analytics and customizable reports that help track performance, optimize operations, and make smarter lending decisions.

Data-Driven Insights

Access real-time analytics and customizable reports that help track performance, optimize operations, and make smarter lending decisions.

Advanced Capabilities

Unlock the full potential of your lending operations with cutting-edge features

QR Code Enabled →

Drive instant lead collection with unique, trackable QR codes for precise attribution.

Instant Lead Capture

Generate Quality Leads →

Capture, validate, and qualify leads seamlessly across every touchpoint in your network.

Multitouch Validation

Build Your Network →

Expand effortlessly with channels, sub-channels, and agents to maximize reach.

Scalable Infrastructure

AI Matchmaking →

Match borrowers with the right lenders and products using AI for smarter, faster conversions.

HyperQ Matchmaking

Secure & Compliant →

Bank-grade security with compliance for KYC, AML, GDPR, and more.

Compliant Workflow

Faster Processing →

Share leads instantly via APIs, UTM links, or uploads for zero workflow delays.

APIs

Optimised Workflow

Your plug and play Intelligent Lending Platform

What is HyperBridge?

HyperBridge is a next-generation automation platform designed to unify lending operations across channels. With embedded AI powered by HyperQ, real-time dashboards, and secure API integrations, it empowering loan intermediaries to build scalable operations.

Qualify leads from both physical and digital channels

Connect with multiple lenders through one hub

Manage networks, partners, and employees with complete transparency

Unlock faster conversions with AI-driven borrower—lender matchmaking.

Seamlessly Connect

Unified API Gateway

Network Management

AI Matchmaking

Lead Qualification

Risk Management

Lender Matching

Risk Assesment

Lead Qualification

HyperQ AI Engine

Intelligent automation at the core

Core Features

Core Features

Capture leads, manage networks, and scale lending with automation, intelligence, and compliance—so you can grow faster and work smarter.

Capture leads, manage networks, and scale lending with automation, intelligence, and compliance—so you can grow faster and work smarter.

Real-time Dashboards

Monitor leads, approvals, and disbursals instantly. Get a 360° view of your lending ecosystem at your fingertips.

Real-time Dashboards

Monitor leads, approvals, and disbursals instantly. Get a 360° view of your lending ecosystem at your fingertips.

AI-powered Credit Matchmaking

Powered by HyperQ, HyperBridge intelligently connects borrowers with the right lender, boosting conversion rates.

AI-powered Credit Matchmaking

Powered by HyperQ, HyperBridge intelligently connects borrowers with the right lender, boosting conversion rates.

Smart Lead Capture & Validation

Collect, validate, and route leads instantly for higher accuracy and faster processing.

Smart Lead Capture & Validation

Collect, validate, and route leads instantly for higher accuracy and faster processing.

Network & Partner Management

Onboard partners, track agents, and optimize team performance seamlessly across all your channels.

Network & Partner Management

Onboard partners, track agents, and optimize team performance seamlessly across all your channels.

Employee Management

Streamline workforce operations with intuitive dashboards, automated workflows, and performance tracking.

Employee Management

Streamline workforce operations with intuitive dashboards, automated workflows, and performance tracking.

Data-Driven Insights

Access real-time analytics and customizable reports that help track performance, optimize operations, and make smarter lending decisions.

Data-Driven Insights

Access real-time analytics and customizable reports that help track performance, optimize operations, and make smarter lending decisions.

Advanced Capabilities

Advanced Capabilities

QR Code Enabled →

Drive instant lead collection with unique, trackable QR codes for precise attribution.

Drive instant lead collection with unique, trackable QR codes for precise attribution.

Instant Lead Capture

Generate Quality Leads →

Capture, validate, and qualify leads seamlessly across every touchpoint in your network.

Multitouch Validation

Generate Quality Leads →

Capture, validate, and qualify leads seamlessly across every touchpoint in your network.

Multitouch Validation

Build Your Network →

Expand effortlessly with channels, sub-channels, and agents to maximize reach.

Scalable Infrastructure

AI Matchmaking →

Match borrowers with the right lenders and products using AI for smarter, faster conversions.

HyperQ Matchmaking

Build Your Network →

Expand effortlessly with channels, sub-channels, and agents to maximize reach.

Scalable Infrastructure

AI Matchmaking →

Secure & Compliant →

Match borrowers with the right lenders and products using AI for smarter, faster conversions.

Bank-grade security with compliance for KYC, AML, GDPR, and more.

HyperQ Matchmaking

Compliant Workflow

Secure & Compliant →

Faster Processing →

Bank-grade security with compliance for KYC, AML, GDPR, and more.

Share leads instantly via APIs, UTM links, or uploads for zero workflow delays.

Compliant Workflow

Optimised Workflow

Faster Processing →

Share leads instantly via APIs, UTM links, or uploads for zero workflow delays.

APIs

Optimised Workflow

Unlock the full potential of your lending operations with cutting-edge features

Unlock the full potential of your lending operations with cutting-edge features

Why Choose HyperBridge

HyperBridge empowers lenders and intermediaries with automation, real-time insights, and growth-ready tools—built to simplify and scale lending.

End-to-End Automation

Manage leads, partners, channels, and agents in one place.

Scalable Architecture

Modular design that grows with your business.

Seamless Integrations

Seamless Integrations – APIs and embedded credit engines

AI + Data-Driven Insights

Smarter decisions, better conversions.

Future-Ready Compliance

Secure, compliant, and reliable.

Growth Enablement

Expand your lending ecosystem with transparency and control.

HyperBridge empowers lenders and intermediaries with automation, real-time insights, and growth-ready tools—built to simplify and scale lending.

Why Choose HyperBridge

End-to-End Automation

Manage leads, partners, channels, agents in one place.

End-to-End Automation

Manage leads, partners, channels, agents in one place.

Scalable Architecture

Modular design that grows with your business.

Scalable Architecture

Modular design that grows with your business.

Seamless Integrations

Modular design that grows with your business.

Seamless Integrations

Modular design that grows with your business.

AI + Data-Driven Insights

Smarter decisions, better conversions.

AI + Data-Driven Insights

Smarter decisions, better conversions.

Future-Ready Compliance

Secure, compliant, and reliable.

Future-Ready Compliance

Secure, compliant, and reliable.

Growth Enablement

Expand your lending ecosystem with transparency and control.

Growth Enablement

Expand your lending ecosystem with transparency and control.

HyperBridge: Your All-in-One Lending Operating System

HyperBridge: Your All-in-One Lending Operating System

© 2025 Hyperfin Technologies Pvt. Ltd. All rights reserved.

© 2025 Hyperfin Technologies Pvt. Ltd. All rights reserved.

End-to-End Automation

Manage leads, partners, channels, agents in one place.

End-to-End Automation

Manage leads, partners, channels, agents in one place.

Scalable Architecture

Modular design that grows with your business.

Scalable Architecture

Modular design that grows with your business.

Future-Ready Compliance

Secure, compliant, and reliable.

Future-Ready Compliance

Secure, compliant, and reliable.

Growth Enablement

Expand your lending ecosystem with transparency and control.

Growth Enablement

Expand your lending ecosystem with transparency and control.

HyperBridge empowers lenders and intermediaries with automation, real-time insights, and growth-ready tools—built to simplify and scale lending.

Why Choose HyperBridge

Seamless Integrations

Modular design that grows with your business.

Seamless Integrations

Modular design that grows with your business.

AI + Data-Driven Insights

Smarter decisions, better conversions.

AI + Data-Driven Insights

Smarter decisions, better conversions.

Comprehensive Dashboard

© 2025 Hyperfin Technologies Pvt. Ltd. All rights reserved.